When South Africa’s energy leader Sasol announced a pathbreaking corporate venture capital (CVC) mandate, with Emerald as advisors, it signaled its intention to utilize startup collaboration as a key lever in its sustainability transformation.

In this interview, we speak with Nicole Wainer, the commercial lead of Sasol Ventures, to review the role of CVC in Sasol’s decarbonization aims and where the technology opportunities are ripest.

The venture fund is meant to support Sasol’s net-zero strategy. What is the thinking within Sasol behind that strategy?

In 2021, Sasol defined its climate change ambitions: 30% reduction of absolute scope 1 and 2 emissions by 2030 and full net zero by 2050. In South Africa, we have a unique challenge in that we are a significant single-point emitter of CO2. We have to find innovative ways to produce our chemicals and energy products more sustainably.

How does Sasol Ventures contribute to this goal? How do you position it as an opportunity for Sasol shareholders?

Technology is a key enabler of Sasol’s transformation, and currently the relevant technologies are expensive or not yet available at scale. Where a typical venture fund is all about financial return targets—and of course we have those too—the real value for Sasol lies in identifying technologies that are out there, in watching innovation develop and understanding how the solutions and cost curves of what we need for our transition are shifting.

The deeper value of Sasol Ventures lies in how we gain insights, collaborate with startups in new and innovative ways, and test their products or processes so that the rest of our operations are able to change as they need to change, in a way that makes our new businesses viable.

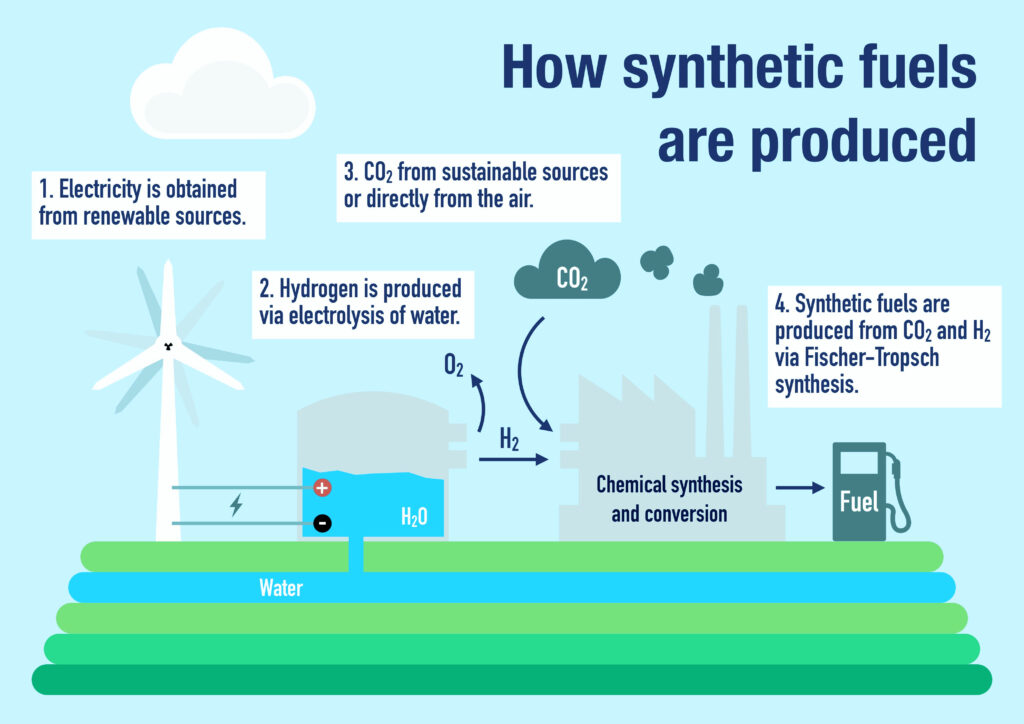

Sasol’s key competencies have traditionally involved creating molecules from different chemical processes, specifically liquid fuels from coal via the Fischer-Tropsch pathway. What do you view as the most promising opportunities for “green” molecules in the energy sector that don’t require fossil carbon as their main input?

Sustainable aviation fuel is currently an area of opportunity—both for our South African energy business as well as the new ecoFT business, via carbon extracted from biomass, or perhaps taken directly out of the air at some point in the future. On the chemical side, we see lots of opportunity for the creation of sustainable products, including from our facilities in the US and in Germany. Surfactants, lubricants and plastics made from sustainable biomass or with captured or waste carbon, all represent potential opportunities to harness green molecules.

Few doubt that electrification will play a key role in the energy system of the future. What is Sasol’s strategy to take advantage of the opportunity electrification will present?

Given the challenges our electricity sector is facing, South Africa may see a slower pace of electrification compared with the developed world. Still, there’s no question that electric mobility will be part of our future and a space Sasol must play in.

There are a number of exciting downstream applications in distribution and optimization for charging networks, for instance—areas I could see us playing a role in down the line.

The electrification of many parts of our processes and facilities will also be important in moving from fossil fuels to renewable energy.

How has the role of CVC evolved within Sasol over the last several years? How has collaboration with startups become more structured and formalized?

Our businesses have had collaboration with startups in many areas, and we continue to explore this via plans for innovation hubs, for example, where a smaller company can, say, test or apply their technology on our site. Different technologies for hydrogen electrolysis may be good examples of this, where we create a win-win environment. The developer has an opportunity to prove or scale their technology, and we potentially gain access to exciting new innovation in a critical area.

At Sasol Ventures we can plug into that mindset and expand it in many directions. Even startups which are not investment opportunities for the fund can connect to a business unit because they are still seriously interesting for Sasol from a collaborative perspective. The business can engage to, say, get their samples or let them come and install their products at our plants.

I see our role as matchmaking the Sasol business units with those companies and helping them utilize those innovations within their day-to-day operations.

How do you see the Emerald partnership advancing Sasol’s CVC aims in clean energy?

The Sasol ventures team is very lean, and we rely on Emerald to provide the expertise and resources that we do not have.

Emerald emphasizes strategic value creation alongside financial value creation, which is an appealing long-term prospect when we’re thinking about transformation via collaboration. Emerald is always thinking of ways to advance collaboration in addition to investment—this is strongly aligned to the ambition of Sasol Ventures. In this regard, they are always challenging us. How do you see opportunities you may not have seen before, to unearth avenues that did not appear obvious if you are just looking at a company from the perspective of a venture deal?

Thinking two or three years down the road, what will a successful partnership with Emerald and successful role for CVC in Sasol look like?

Like most large corporates, Sasol is used to doing large projects that take years to put into place. Venture capital has a more risky, fast-fail mindset. There’s definitely an element of growing and learning and seeing how this is done—one of the key reasons why we see our partnership with Emerald as so important.

Our two-to-three-year target is to start to build the portfolio, to create investments that are clearly in line with the core strategy of the fund—which has to be aligned to Sasol’s sustainability strategy—and to ensure that those investments have clear benefits and synergistic effects for us. In the process we hope that we create a number of additional collaboration opportunities that are not necessarily investment opportunities.

We want Sasol Ventures to be something that complements our existing R&D and which business units can tap into when they have a difficult challenge that needs innovation and new technology to solve.